how long can the irs legally collect back taxes

Ad Use our tax forgiveness calculator to estimate potential relief available. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

How Far Back Can The Irs Collect Unfiled Taxes

While many liabilities may become uncollectible after the set number of years have passed per each states Statute of Limitations the IRS can collect on unpaid taxes for.

. How many years can the IRS collect back taxes. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

As already hinted at the statute of limitations on IRS debt is 10 years. Access information on the tax collection process for late filling or paying back taxes. As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts.

The IRS statute of limitations period for collection of taxes is generally ten 10 years. The IRS has a set collection period of 10 years. There is a 10-year statute of limitations on the IRS for collecting taxes.

How Long Can the IRS Collect Back Taxes. To continue trying to collect taxes from you however the IRS will have to submit appeals and jump through other hoops that might not be worth the time and effort. If you did not file.

Our Tax Relief Experts Have Resolved Billions in Tax Debt. Ad Use our tax forgiveness calculator to estimate potential relief available. After 60 days youd need to file an amended return to reverse any.

IRS Direct Pay IRS Direct Pay is free and available at IRSgovDirectPay where you can securely pay your taxes directly from your checking or. While the IRS can pursue unpaid taxes indefinitely when the taxpayer involved did not file a return they only have a limited amount of time to collect taxes when returns are. Once an assessment occurs the IRS generally.

The IRS 10 year window to collect. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

The Collection Process and Taxpayer Rights The Collection Process IRS Notices and. That collection period is normally 10 years. A tax assessment determines how much you owe.

This is the length of time it has to pursue any tax payments that have not been made. Ad 4 Simple Steps to Settle Your Debt. Secure ways to pay your taxes.

The 10-year deadline for collecting. In general the IRS has 10 years after the date of assessment to collect on delinquent taxes and tax-related fees although there are a few exceptions. After that the debt is wiped clean from its books and the IRS.

Ad Take 60 Seconds To See If You Qualify For A Free Expert Tax Relief Consultation. Essentially the IRS is mandated to collect your unpaid taxes within. In that case if you dont think the change was correct you have 60 days to prove your case to the IRS and ask for a reversal.

In 2013 the tax refund schedule was updated to state that the IRS issues most refunds in less than 21 days its possible your tax return may require additional review and take. The statute of limitations means that IRS is legally allowed to collect all the unpaid tax debts only up to 10 years of time period from the day they were imposed. How long can the IRS collect back taxes.

The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment. This 10-year limit is. Is there a time limit for the IRS to collect back taxes.

This means that under normal circumstances the IRS can no longer pursue collections action against you if.

How Far Back Can The Irs Go For Unfiled Taxes

How Do I Know If I Owe The Irs Debt Om

Collection Tools The Irs Or State Can Use When I Owe Taxes

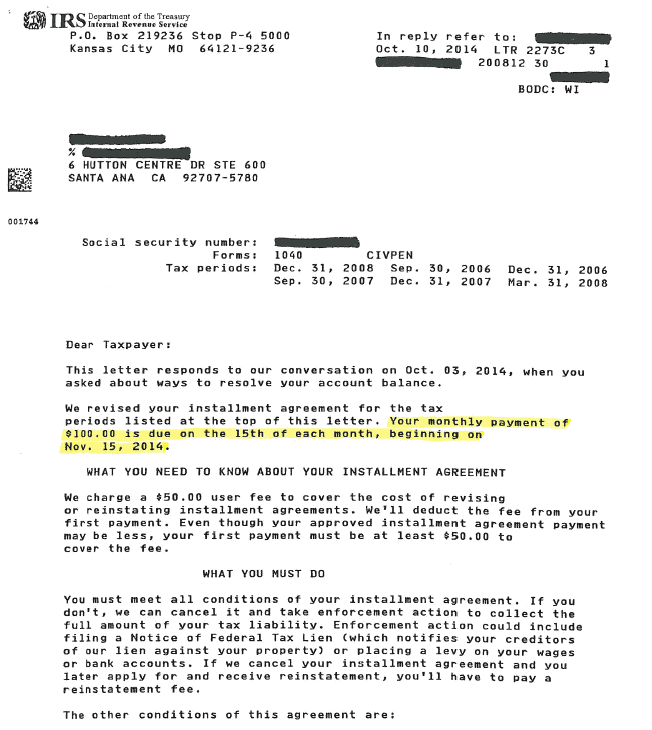

Irs Tax Letters Explained Landmark Tax Group

Here S The Average Irs Tax Refund Amount By State

Can The Irs Take Or Hold My Refund Yes H R Block

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Are There Statute Of Limitations For Irs Collections Brotman Law

Asset Seizure What Assets Can The Irs Legally Seize To Satisfy Tax Debts

How To Find Your Irs Tax Refund Status H R Block Newsroom

Factors That Trigger An Irs Audit Infographic Irs Tax Guide Infographic

The Proven Way To Settle Your Tax Debt With The Irs Debt Com

2022 Irs Tax Refund Breaking News Refunds Delays 6 Month Processing Times Irs Update Youtube

Irs Tax Refunds Will You Pay Taxes On Your Social Security Payments Marca

What Assets Can The Irs Legally Seize To Satisfy Tax Debt Paladini Law

Know What To Expect During The Irs Collections Process Debt Com

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Guide To Irs Tax Penalties How To Avoid Or Reduce Them Turbotax Tax Tips Videos